Founders and investors converged at the 2025 Entrepreneur Expo for the "Access to Capital: Different Funding Sources for Startups" panel. Recognizing that securing funding is a universal hurdle for early-stage companies, this session served as a strategic roadmap, confirming that Maryland’s robust capital ecosystem is actively engineered to fund visionary ideas and drive next-level growth at every stage.

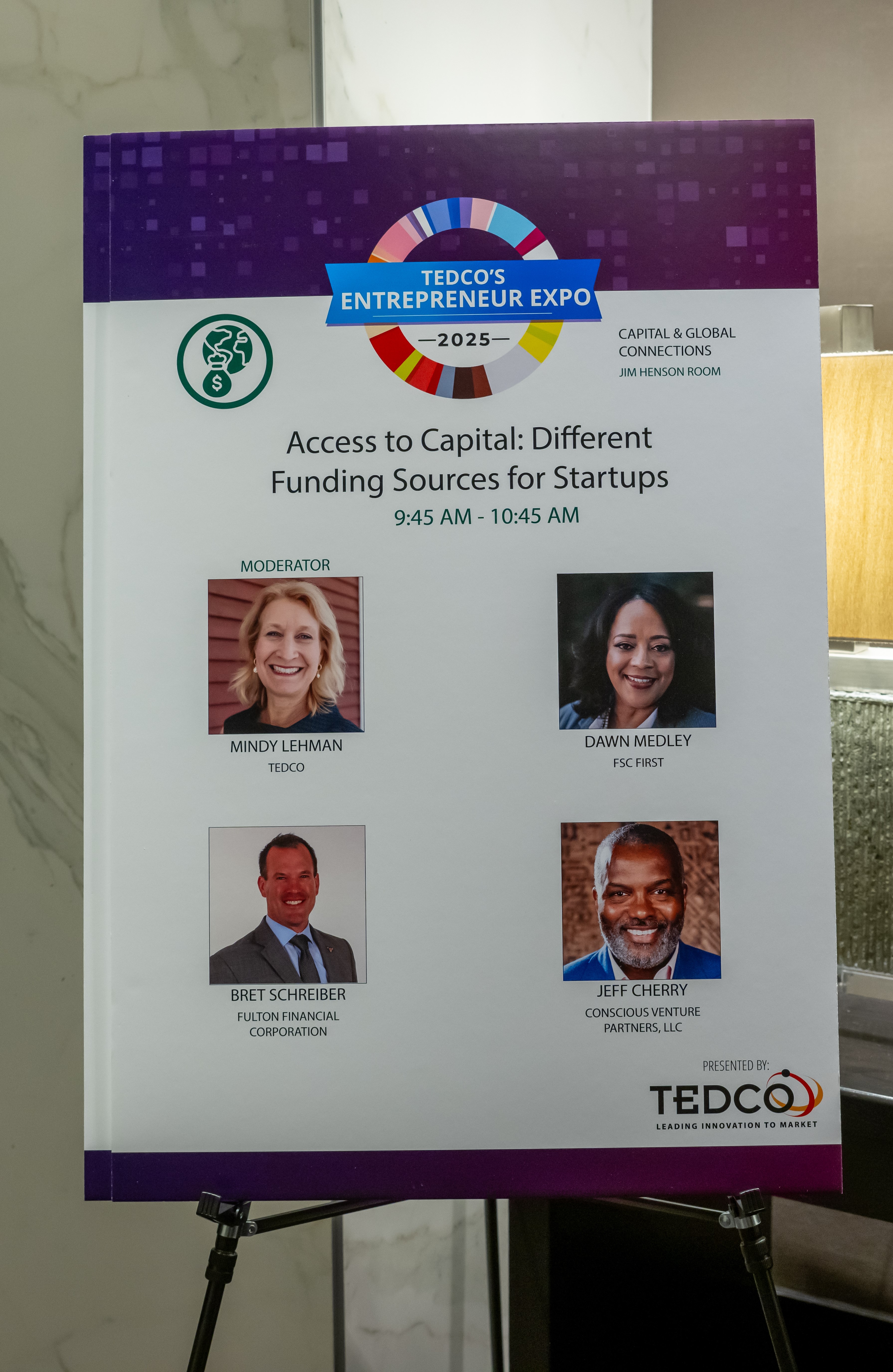

Moderated by Mindy Lehman of TEDCO, the session featured an authoritative assembly of leaders who collectively are active through the full spectrum of capital: Jeffrey Cherry, managing partner of Conscious Venture Partners LLC, Dawn Medley, president and CEO of FSC First and Bret Schreiber, senior vice president, life sciences and technology, Fulton Bank. Their unified message was clear: the money is here, but success demands preparation, self-awareness and the relentless pursuit of connection.

The Capital Spectrum: Fueling Every Stage of the Journey

The panel demonstrated that Maryland’s financing is a three-dimensional chessboard, offering specialized capital tailored to a founder’s specific need—from the initial spark of an idea to scaling high-volume debt.

Cherry of Conscious Venture Partners (CVP) clarified the role of high-risk, high-reward early-stage equity. CVP specializes in being the "first professional money in." Cherry defined this venture mindset: "We're risk capital. We expect, quite frankly, nine out of the ten investments that we make to not work out." CVP's focus is laser-targeted: finding high-potential ideas from underrepresented founders in overlooked communities. As Cherry noted, "We think there are really smart people everywhere. There's just not an opportunity everywhere. So, we are trying to do a better job of bringing opportunities to people and places that are overlooked for all the wrong reasons."

Next, Medley introduced FSC First, the mission-driven institution designed to fill the gap before traditional banking is possible. As a Community Development Financial Institution (CDFI) and SBA lender, FSC First offers microloans, SBA loans and essential lines of credit. Medley offered critical advice for the application process: "Don't try to decide what funding you need. Because when you go to the website, you're going to get ran over by a bunch of programs. Don't worry about that. Just apply...we'll fit you with the right money. We know what program is going to be the friendliest to your kind of business." Medley also explained that FSC First also provides a lifeline of support through their technical assistance program, "Level Up."

Completing the panel was Schreiber of Fulton Bank, who described how non-traditional debt is deployed for mature life science and technology startups. Schreiber explained their innovative approach: "We built this division around the individual companies that we support. We threw out the existing credit policy, have our own existing credit policy, and we're looking more at the narrative of the company." This means Fulton lends on a company's "story" and verifiable milestones—like secured patents or federal SBIR grants—rather than requiring years of revenue history. Fulton also acts as a powerful network connector, linking founders to a vast network of over 115 equity funders.

The Currency of Trust: Beyond the Balance Sheet

A recurring theme woven through the discussion was that funding decisions are fundamentally human, relying on the founder's character and preparation as much as their balance sheet.

Lenders and investors alike emphasized that the path to capital is paved with organized, honest data. Founders must demonstrate rigorous self-discipline through organized financials (timely tax filings, P&Ls) and realistic, thoughtful projections.

Cherry specifically addressed the necessity of humility and professional support, advising: "Some of you are going to have to be humble enough to step aside and recognize that you have to bring in some help to help around the company." He provided practical advice on financial readiness: "Make sure you do have your house in order. If you don't, there's a lot of really fantastic partial CFO programs out there you can reach out to.”

Furthermore, the panel urged founders to embrace humility. Schreiber advised that founders must ruthlessly identify their skill gaps—whether in finance, operations or technology—and be willing to recruit help, stating that bringing in a fractional CFO or a strategic advisor signals maturity and reduces risk for funders.

Navigating the Capital Shift: New Frontiers in Funding

The panelists pivoted to the current financial climate, acknowledging the significant turbulence caused by funding uncertainty, particularly in grants like SBIR. This disruption is creating a capital gap that requires a fundamental evolution in how Maryland funds its growth.

The solution, according to the experts, lies in a strategic pivot toward new capital sources. Schreiber articulated the call for corporate and philanthropic engagement: "We need companies to be able to step up and start funding innovative technologies. I think foundations need to be looking at some of their missions and perhaps do like what the Abell Foundation does within the city of Baltimore where they do impact investing from a venture philanthropy standpoint."

In response, institutions like FSC First are deepening their focus on state and local funding sources, which often provide critical advantages for startups: lower interest rates, longer repayment terms and customized underwriting. This local capital is more resilient to national volatility and offers terms designed to foster sustainable growth, not predatory returns.

Cherry affirmed that the founder's response to these shifts must be proactive. Disruption is inevitable, but a continuous learning mindset is the best defense. Founders must be learners, not knowers, constantly evolving their plans and their networks.

The final call to action was simple and powerful: build your network before you need it. Utilize the free resources available—from FSC First's "Level Up" program to the expansive network of equity funders connected through institutions like Fulton Bank to the vast resources and programs found through TEDCO.

Your Next Move: Seizing the Advantage

Maryland is committed to engineering an ecosystem where opportunity is never constrained by a lack of capital. The only remaining variable is the founder's preparedness to claim it.

Bret Schreiber provided the ultimate foundational mindset: "You always need to be out there moving. You always need to remain hungry. A mentor of mine once told me that there's a dangerous place to view the world from behind the desk."

Source: Washington Business Journal